The debt ceiling is being talked about more and more - but what exactly is the debt ceiling? Why do we have one? And how should it be addressed? FreedomWorks is here to break it down.

You’ve probably here’s plenty of talking points about the debt ceiling over the years… but talking points don’t always tell you what you need to know. What exactly is the debt ceiling? Why do we have one? And how should we address it? Let’s break it down.

Ultimately, this topic boils down to what the government does best: spending money. The government pays for its spending with revenue – aka the money it brings in, typically through taxes. And while you might feel like you pay a lot in taxes, the government also spends a lot. More, actually, than we pay. This leaves the government with a deficit. How does the government deal with a deficit? It borrows money to make up the difference – promising to pay it back later. Add up all of these accumulated deficits, and you’ve got what we lovingly refer to as the National Debt.

So to answer what the debt ceiling is, that’s fairly straightforward: It’s a limit placed on how much money the government is allowed to borrow. Raising the debt ceiling doesn’t, in itself, authorize new spending – it manages what we’ve already spent. But countries having a debt ceiling isn’t normal. How did we end up with one?

For most of U.S. history, Congress actually kept a close watch on our debt – specifically authorizing every expenditure that would add to it, as well as providing details for how the money would be borrowed and paid back. This process began to loosen in 1917 as America scrambled to pay for World War I. But as we approached World War II, Congress streamlined the process further by simply setting a limit for how much debt could be accrued – and beyond that, the Treasury Department was given broad leeway regarding how America would borrow and pay back the money.

In 1939, the very first debt limit was set at 45 billion dollars – raised to 275 billion by 1946 (not adjusted for inflation). Now today Congress couldn’t throw a pizza party for less than that, but back in the day, they used it to pay for World War II. Ever since, Congress has spent money with impunity – leaving the messy details of where the money comes from to the bureaucrats in the Treasury Department. All Congress had to do was raise the debt ceiling every once in a while. Which they did.

Slowly over time, the debt grew, and the ceiling was raised alongside. A few spats came up now and then, but most in Congress were happy to spend a little more… and go a little more into debt. Then spending began to rise at a higher and higher rate – and the debt ceiling had to keep up. Then came 2011, when a new Republican-controlled House flexed its muscles and demanded spending cuts before they would raise the debt ceiling. The leftist media pummeled them nonstop for daring to care about our country’s dire financial path.

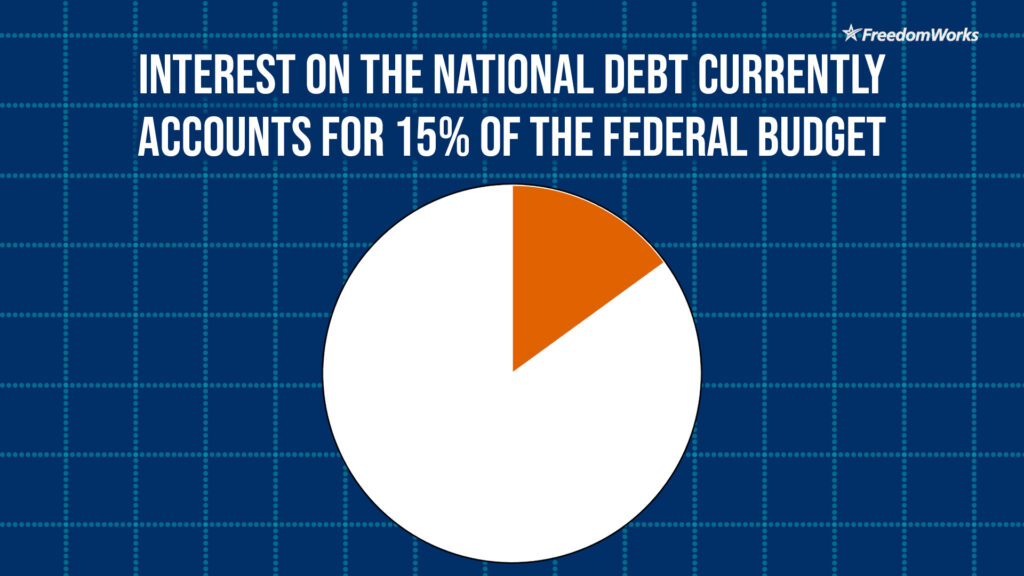

Eventually, some modest spending cuts were agreed to, and the debt ceiling rose once again. But there were lasting scars: for the first time in history, America’s credit rating was downgraded – suggesting that investment in the U.S. was not as safe as it once was. Critics were quick to point to the political fight over the debt ceiling as the culprit – which is partially true – but they typically overlooked the listed problem of the debt itself. In 2023, the national debt passed 31 trillion – and is projected to triple to nearly 90 trillion by the end of the decade. As of now, paying off interest on the debt – because yes, there’s interest – accounts for a full 15% of the federal budget. And that will only grow.

So what can be done to address this? Well it won’t get rid of the debt we already have, but we could start by actually bringing our spending and revenue into balance – removing the need for more debt. You could do that by raising revenue – again, taxes – but that level of taxation would be crippling for the American people. So the other option – and hear me out – is to reduce spending. While we don’t have the time to dig into it here, any serious effort on spending would require entitlement reform. Hey, don’t shoot the messenger.

As for the debt ceiling itself – some have suggested we just remove it. Which is kind of like curing a fever by throwing away your thermometer. The debt ceiling itself isn’t the problem – irresponsible spending is. Any solution that doesn’t address that isn’t really a solution. There is nothing unreasonable about bundling a new debt ceiling adjustment together with commitments from Congress to reduce spending going forward. That’s just being responsible with America’s future.

The fact is, by the time the debt ceiling hits the news cycle, it’s already too late. We need to be more proactive in holding our politicians accountable when it comes to spending. And if they’re really good… maybe one day they’ll deserve another pizza party.