CBO to Congress: America Is Broke

Last week, the Congressional Budget Office (CBO) released The Budget and Economic Outlook: 2024 to 2034. As the title suggests, the report offers a glance at the federal budget and key economic indicators in FY 2024 and the ten-year budget window, FY 2025 through FY 2034. The report doesn’t really offer much of a change in the budgetary outlook. The key takeaways are:

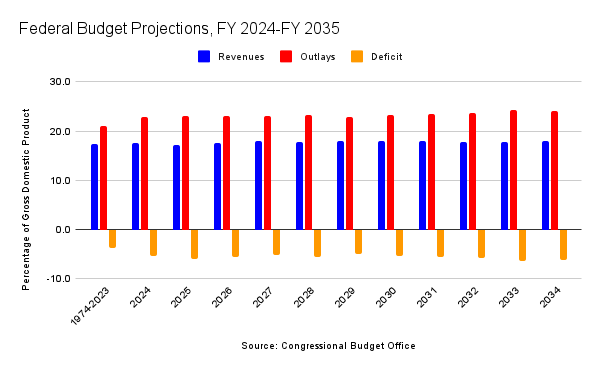

The budget deficit is projected to exceed $1.5 trillion in FY 2024, or 5.3 percent of gross domestic product (GDP). However, the budget deficit is expected to reach nearly $2.6 trillion, or 6.2 percent of GDP, in FY 2034.

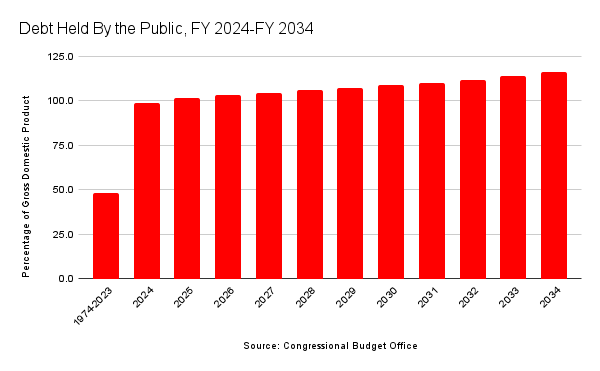

Debt to GDP in FY 2024 is projected to be 99 percent. However, that is projected to rise to 116 percent at the end of the ten-year budget window.

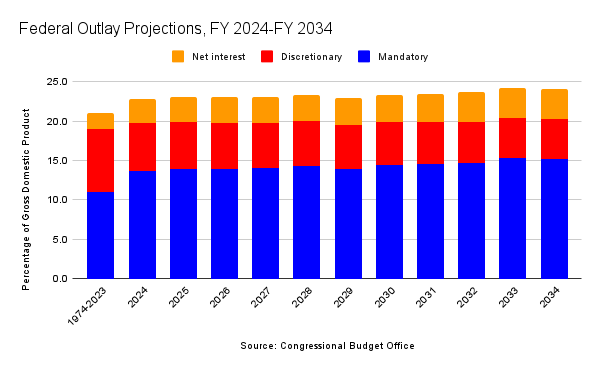

Discretionary spending—what Congress debates and appropriates every fiscal year—is projected to decline from 6.4 percent of GDP in FY 2023 to 6.2 percent in FY 2024 to 5.1 percent in FY 2034. Yet, some in Congress continue focus on discretionary spending while ignoring everything else. The CBO attributes the decline in discretionary spending as a percentage of GDP to the enactment of the Fiscal Responsibility Act.

Mandatory outlays—which includes trust fund programs like Medicare and Social Security—is projected to grow from 13.6 percent of GDP in FY 2024 to 15.2 percent of GDP in FY 2034. The increase in mandatory spending is driven by Medicare and Social Security.

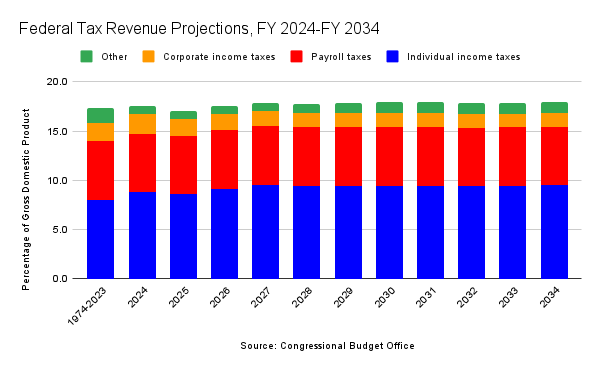

Revenues are projected to rise from 16.5 percent of GDP in FY 2023 to 17.5 percent in FY 2024 to 17.9 percent in FY 2034. The increase in revenues is driven mostly by the expiration of the individual tax changes in the Tax Cuts and Jobs Act. Those changes will expire at the beginning of 2026, which captures the first three months of FY 2026.

Economic growth—or real GDP growth—is projected to be remain at or slightly above 2 percent through FY 2030. However, real GDP growth will fall below 2 percent in FY 2031 and remain below that mark for the remainder of the ten-year budget window.

In this blog post, we’ll get more into detail about the report. There’s a separate blog post coming soon that will cover the CBO’s updated long-term age demographics. The long-term age demographic issues that the United States faces are just as concerning as the budgetary outlook.

Discretionary Spending Is Lower Than Previously Projected

I want to once again emphasize that discretionary spending is what Congress appropriates every fiscal year. When there’s a threat of a government shutdown looming, it’s because Congress hasn’t passed one or more of the 12 annual appropriations bills. Discretionary spending represents less than 27 percent of all federal spending.

The rest of federal spending is mandatory and net-interest outlays, neither of which are subject to congressional appropriation. Mandatory and net-interest spending is dependent on obligations, either based on the number of beneficiaries in mandatory spending programs or interest obligations to those who purchase our debt.

Usually, when you hear a Member of the House or Senate talking about spending, chances are they’re talking about discretionary outlays. The appropriations process has become a way for Democrats and Republicans to fight the culture wars or get “gotcha” votes on amendments that make the other party look bad.

Discretionary spending in FY 2024 is projected to be 6.2 percent of GDP, which is lower than the 6.6 percent that the CBO projected in June 2023. Now, that projection is based on current law and doesn’t include any additional discretionary spending that Congress may authorize. Still, looking at historical figures, this lowest level of discretionary spending as a percentage of GDP that we’ve seen since FY 2001.

From FY 1974 through FY 2023, discretionary spending averaged 8 percent of GDP. Discretionary outlays will fall from the current 6.2 percent of GDP to 5.1 percent by end of the ten-year budget window in FY 2034. These are, as the CBO notes, “historic lows.”

Now, discretionary spending was already projected to decline relative to GDP, but the decline has been accelerated. As the CBO explains, “The biggest factor contributing to smaller projected deficits is a reduction in discretionary spending stemming from the Fiscal Responsibility Act and the Further Continuing Appropriations and Other Extensions Act, 2024.” Both bills were the subject of derision and consternation from conservatives, but they appear to have had the intended impact, by which I mean reductions in discretionary spending relative to GDP.

Although the accelerated decline of discretionary spending is a welcome development, the decline itself is driven more by less than optimal factors than the passage of the Fiscal Responsibility Act and the Further Continuing Appropriations and Other Extensions Act for FY 2024.

Mandatory Spending and Net Interest Are Driving Deficits

The reason I say that the reductions in discretionary spending are driven more so by less-than-optimal factors is that discretionary spending is being crowded out by mandatory outlays and net interest.

Anyone who talks about spending without telling you in the next breath that trust fund programs and interest on the national debt are driving budget deficits and debt are actively part of the problem in Congress. It’s just that simple.

The only way Congress can run a surplus in FY 2024 is if it completely eliminates discretionary outlays—defense and nondefense. That’s right. Congress would have to cut out all defense spending, as well as nondefense spending. Eliminating discretionary spending—again, defense and nondefense—wouldn’t eliminate the budget deficit after FY 2030.

Social Security outlays will rise as a percentage of GDP from 5.2 percent of GDP in FY 2024 to 5.9 percent in FY 2034. Medicare is projected to grow from 3.2 percent of GDP in FY 2024 to 4.2 percent in FY 2034.

Healthcare mandatory programs other than Medicare—including Medicaid, the Children’s Health Insurance Program, and Marketplace health insurance subsidies—are projected to remain relatively stable, increasing from 2.4 percent of GDP in FY 2024 to 2.5 percent in FY 2034. Other mandatory programs are expected to decline from 3.1 percent of GDP in FY 2024 to 2.5 percent in FY 2034.

However, during this ten-year period, the Old-Age and Survivors Insurance (OASI) Trust Fund will run out of money at some point in 2033, based on current projections from the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds and the CBO. The Medicare Hospital Insurance Trust Fund (Medicare Part A) is expected to run dry in 2031. Beneficiaries to both programs will see benefit cuts in the absence of congressional action.

Because our society is growing older, more people are retiring and becoming beneficiaries of these programs. The dedicated revenues to both trust funds, as well as the decline in the number of workers who contribute to them, aren’t keeping up with the amount being disbursed. In short, OASI and Medicare Part A are, to put it diplomatically, actuarially unsound.

House Democrats have introduced a bill, the Social Security 2100 Act, H.R. 4583, to address the fiscal sustainability of the OASI Trust Fund. They’ve been more vocal about this bill recently, likely as an attempt to blunt the proposed Fiscal Commission Act, H.R. 5779. Some conservatives and many House Democrats have a particular dislike of the Fiscal Commission Act, albeit for different, but equally misleading, reasons.

The Social Security 2100 Act is deserving of another post at a later date, but it’s worth pointing out that the legislation represents a massive tax increase that fails to make OASI solvent over the actuarial window. In other words, the bill would buy OASI some time, but it wouldn’t make it solvent.

Larger deficits mean more debt. Net interest will eventually become the largest budgetary expenditure. That isn’t expected to happen in the next decade, though.

Outlays for net interest are, however, projected to surpass defense spending in the current fiscal year. Net interest is projected to surpass all discretionary spending in FY 2043. The share of the debt held by the public is projected to grow from 99 percent of GDP in FY 2024 to 116 percent in FY 2034.

The Bottom Line

The Budget and Economic Outlook: 2024 to 2034 only underscores the precariousness of America’s fiscal situation. We’re trending towards a death spiral, if not already there. Still, most in Congress, as well as many outside groups, are either ignoring our fiscal problems or only paying lip service to them. Economic growth alone isn’t going to solve these issues. Tax increases hurt growth. Solutions have to be bipartisan. That’s the only way out of this mess.

Related Content

FreedomWorks Letter to Congress in Support of the Fiscal Commision Act (H.R. 5779)

FreedomWorks Letter to Congress in Support of Fiscal Commision Act (H.R. 5779)